Most multifamily investors don’t make their best returns by buying perfect buildings. They make them by investing in the messy ones – rents are too low, half the units are empty, and the current management has checked out.

A multifamily property repositioning loan is designed for this exact situation. It gives you capital and time to improve performance before the property qualifies for long-term financing.

Here is how you use a repositioning loan to fix the asset and prep for a permanent exit.

What is multifamily property repositioning?

In multifamily investing, repositioning refers to improving both the physical condition and the operating performance of a property.

The goal is to hike the rent and reduce the risk. Repositioning reduces uncertainty. It smoothens cash flow, improves occupancy stability, and strengthens operations.

Repositioning typically uses several levers together:

- Renovating units so that they reflect renter expectations in the submarket

- Rent resets based on actual leasing demand

- Operational fixes such as faster turns and tighter leasing processes

- Tenant mix changes that support collections and retention

- Resolving deferred maintenance

The focus is on creating stable, repeatable income rather than surface-level improvements.

When do you need a multifamily repositioning loan?

Repositioning loans apply when the property has potential but does not yet qualify for permanent debt.

You may need this type of financing if:

- The property generates cash flow, but well below its market potential

- Occupancy is temporarily depressed

- In-place rents do not yet support Debt Service Coverage Ratio (DSCR).

Debt Service Coverage Ratio (DSCR)

DSCR measures whether current property income can cover loan payments. Agency lenders typically calculate DSCR using in-place or trailing income, not projected rent growth.

A common scenario is an older multifamily property built in the 1970s. Comparable properties in the same submarket have already been renovated and repositioned, allowing them to push rents and stabilize occupancy.

Your building is stuck in the past, while the neighbors are raising their rents. Operations have also not kept pace with current expectations, and vacancy has increased, despite demonstrated demand in the area.

At this stage, conventional lenders typically step back. What you need is a repositioning loan.

Repositioning loans vs other multifamily financing

Different stages of asset performance require varying levels of capital.

| Loan type | Best for | Key limitation |

|---|---|---|

| Agency loans | Stabilized assets | No rehab flexibility |

| Permanent DSCR loans | Post-stabilization | Requires seasoning |

| Traditional multifamily bridge loans | Short timing gaps | May not fund rehab |

| Repositioning loans | Transitional assets | Short-term by design |

Repositioning loans generally price higher than permanent debt. Lenders take on renovation risk, lease-up risk, and timing uncertainty. As execution risk declines, lower-cost capital becomes available.

Market condition: why execution matters

Market conditions shape how repositioning plans play out.

Freddie Mac’s 2025 Multifamily Outlook report says rent growth is slowing down and more units are hitting the market. This environment makes repositioning more execution-driven.

When market rent growth slows, value comes from operations. You have to run the building better than the last person did.

Funding renovations and stabilization

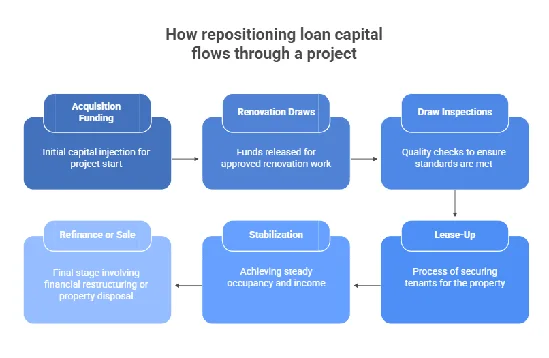

This is where repositioning loans differ most from conventional financing.

Lenders are underwriting the business plan, not just the building.

Renovation budgets are reviewed line by line.

Capital is released through draw schedules after work is verified. Lease-up assumptions are evaluated against market realities rather than projections.

Repositioning loans typically carry interest-only payments during renovation and lease-up, allowing operating cash flow to fund day-to-day operations until stabilization.

Typical multifamily repositioning loan terms

With repositioning loans, the structure of the financing matters more than the advertised price.

Common characteristics include:

- Loan terms of 12 to 36 months

- Interest-only periods during execution

- Rehab holdbacks tied to verified progress

- Defined exit expectations

Terms vary widely based on execution risk and sponsor experience.

Who are these loans designed for?

Repositioning loans are designed for active investors.

Lenders typically expect:

- Relevant experience or strong operating partners

- Sufficient liquidity to manage unexpected issues

- A clearly defined stabilization and exit strategy

- Professional property management during execution

This alignment protects both the investor and the lender.

Common risks in multifamily repositioning and how lenders mitigate them

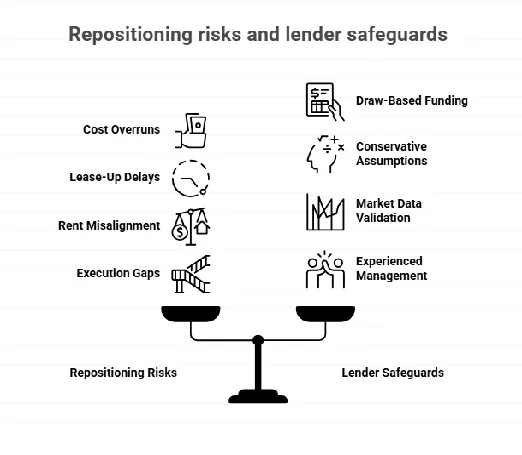

Repositioning risk is execution risk. Most challenges fall into four areas.

1. Cost overruns often stem from underestimated scopes or deferred maintenance surprises. Lenders mitigate this through conservative budgets, contingency planning, and draw-based funding.

2. Lease-up delays can occur when renovations disrupt occupancy or when leasing operations are unprepared. Lenders review absorption assumptions and management plans to reduce this risk.

3. Market rent misreads happen when projected rents rely on the wrong comparables. Lenders underwrite to supportable rents rather than best-case scenarios.

4. Operational execution gaps arise from staffing issues or weak processes. Professional property management helps maintain discipline during transition.

Freddie Mac’s Multifamily Maturity Risk Report highlights that slower fundamentals and higher interest rates increase refinance risk for maturing loans, reinforcing the importance of stabilization before permanent financing.

A short reality check

Repositioning rewards execution.

Deals that depend on perfect timing and flawless outcomes tend to carry more risk. Well-structured plans anticipate slower lease-up, cost pressure, and operational adjustments.

Stormfield Capital repositioning loan program

Stormfield Capital offers a multifamily value-add loan program designed to support investors during the repositioning and stabilization phase of multifamily assets, subject to underwriting.

Focused on transitional multifamily

Stormfield’s value-add financing is intended for transitional multifamily properties that require improvement before qualifying for long-term financing. These typically involve light-to-moderate value-add strategies supported by a defined stabilization plan.

Asset-first, plan-driven underwriting

Transactions are evaluated based on the underlying asset and the proposed business plan, rather than in-place performance alone. Income projections and renovation scopes are reviewed to assess feasibility and execution risk, with final terms determined through underwriting.

Speed without sacrificing discipline

As a direct lender, Stormfield is positioned to support acquisition and repositioning timelines while maintaining a structured underwriting process, subject to credit and asset review.

Transparent execution

Loan structures and expectations are established through underwriting and documented at closing, providing clarity around execution and exit planning during the repositioning period.

Final takeaway

A multifamily property repositioning loan is not a shortcut; it is a transition tool.

Used well, it gives you time to fix operations, stabilize cash flow, and reduce risk in a controlled way. Used poorly, it magnifies execution mistakes and refinance pressure.

Successful investors use repositioning loans with a clear plan, realistic timelines, and a defined exit.